There is a chill in the air, and while many are starting to think about heating their homes and properties this winter, some are feeling a bit apprehensive in light of the heating oil prices they’re seeing.

Unfortunately, these prices and this volatility isn’t anything new. In fact, we’ve been monitoring the volatility we’ve experienced the last 12-24 months particularly close – with supply concerns spurring since the close of last heating season.

For instance, back in March, oil prices were unprecedentedly volatile as a result of the Russia Ukraine war. The volatility spurred from severe supply concerns from many world oil consumers. In May, we saw record high diesel prices with record low diesel inventories, especially on the East Coast. And in June, fuel prices continued to rise with depleting inventories and the continued increase in demand.

So here we are, at the beginning of heating season, facing high heating oil prices. How are we still here?

Heating Oil Price Components

First thing’s first — it’s important to remember that heating oil and diesel are virtually the same fuel in terms of chemical composition. So when you drive by the gasoline station and see the price of diesel, expect the price of heating oil to be similar.

The price of heating oil is made up of two components: The price of the fuel itself, and the cost to transport the fuel. Both costs are extremely high right now as supply is extremely limited.

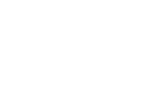

Currently, the average price of heating oil is $5.726 per gallon. At this time last year, heating oil was averaging closer to $3.20 per gallon – an increase of 78%.

Why Are Prices So High?

Besides the price of the commodity itself and the transportation cost of heating oil, there are other factors that are affecting the price of heating oil.

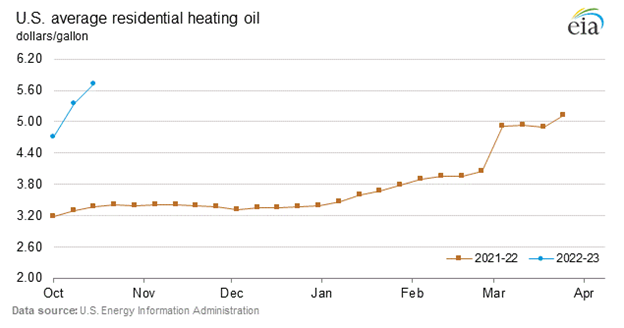

Depleting Inventories

While inventories have been low most of the year, right now, fuel inventories are about 25% lower than they need to be. For the week of October 7, 2022, the United States had an inventory of 106 million barrels of heating oil, which is 31 million barrels below the five-year average for October. An average October should have closer to 140 million barrels in inventory.

We’ve been seeing supply shortages for nearly two years. One of the biggest factors in the equation is the sanctions placed against Russia. Many countries have vowed to not buy Russian oil, leaving them scrambling to buy from other suppliers, including the United States. And many U.S. suppliers are exporting inventories to Europe at a higher profit versus selling locally – further reducing U.S. inventory as global demand increases.

Another reason for the depleting inventories is OPEC+’s recent decision to cut production by 2 million barrels per day in November. This announcement resulted in a $.50 spike in heating oil prices for October and November within just a couple of days.

Lack of Refineries and Rising Refining Costs

Many refineries shut down during the COVID-19 pandemic when people weren’t using as much fuel. Some refineries have chosen to not come back online because of the rising operational costs, and a shortage of workers to run the refineries.

In addition to the reduced number of refineries, those that are operational are opting to use whatever crude oil supplies they have and turning it into gasoline versus taking the additional time to refine the crude into heating oil. This is also why gasoline is so much cheaper than heating oil this year.

Backwardation

These dangerously lower inventory levels have led to additional problems for terminal owners. Many terminal owners are reluctant to stockpile fuel because of “backwardation.” Backwardation is when the current price of oil is higher than prices trading in the futures market. It can take more than two weeks for the fuel to arrive from its source down south to the New York area. If prices drop during the time the fuel is in transit, then a significant amount of profit could be lost. This is not a risk terminal owners are willing to take.

Colder Forecasted Temperatures

One more contributing factor, compounding the issues associated with high heating oil prices, is the colder than normal winter expected in the Northeast. The Farmer’s Almanac is predicting a “shivery and snowy” winter across much of the Midwest and along the East Coast with freezing temperatures and higher than normal snowfall averages.

It’s Not Just Heating Oil

While heating oil prices are high, the price for other commodities has skyrocketed as well. Natural gas is facing similar issues—supply shortages and increasing demands.

Navigating this volatility can be challenging but we’re here for you – monitoring the energy markets on a daily basis to help you make the most informed decisions and standing ready to deliver as your full-service reliable energy provider. Connect with an energy advisor today or follow us on LinkedIn for market updates and energy news.