If you’ve driven by a gas station recently, you’ve definitely seen very high prices. The price for a gallon of regular gasoline is averaging $4.33 across the United States, but diesel is averaging over $1 more, at $5.62 per gallon, up nearly 60% since January. In fact, on the East Coast, it isn’t unusual to drive by a station and see diesel prices topping $6 per gallon in some places!

Diesel fuel used in diesel-powered vehicles and other engines is basically No. 2 heating oil. The only difference is that heating oil has a dye added to it that distinguishes it from untaxed or lower-taxed fuels. The higher-taxed diesel fuels are used for over-the-road vehicles. Therefore, rising diesel prices also means high heating oil prices.

Diesel is also known as the fuel that powers the country. Diesel powers most of the transportation networks in the United States, like the big rigs that haul goods, city buses, barges, and trains, as well as agriculture and construction equipment. So more expensive diesel also therefore means the price of everything else will likely increase.

Why is diesel more expensive than gasoline?

Since both diesel fuel and gasoline are made from crude oil, some would expect prices to be similar. But there are a number of factors that make diesel more expensive. Much more expensive.

For starters, the price of diesel is higher than gasoline because of federal and state taxes on diesel. On-highway diesel fuel is taxed just over 24 cents per gallon, versus the 18 cents per gallon that gasoline is taxed at. The higher tax on diesel fuel goes toward fixing transportation infrastructure, as the vehicles that use diesel are often the ones creating more damage to the surface of the road because of their weight.

Diesel fuel is also more expensive than gasoline because of the way it is produced in the refineries. Since the switch to Ultra Low Sulfur Diesel (ULSD) between 2006 and 2010, which pollutes less than previous types of diesels, the way diesel is produced has changed, leading to higher costs, which, of course, get passed on to the consumer.

Finally, diesel is more expensive than gasoline because the demand is high in both the United States and worldwide. Because of its multiple uses within the transportation and agricultural industries, as well as its use as a heating oil, the demand for diesel has increased.

But what is making the prices climb so high?

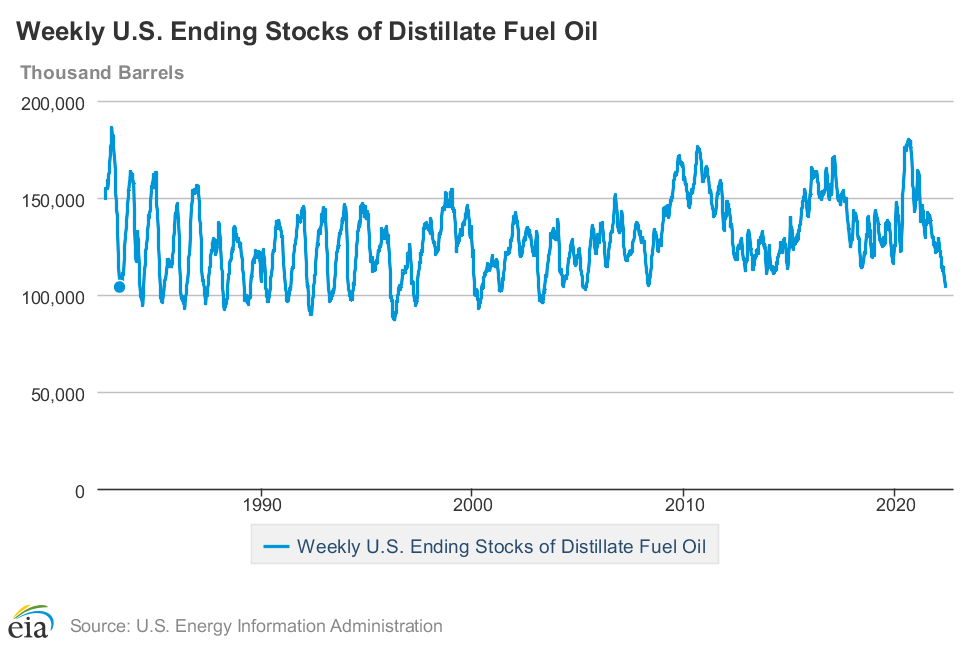

Low inventory. The United States is seeing its lowest diesel inventory in a long time. According to the EIA, the United States’ distillate inventories, which make up diesel and heating oil supplies for the start of May 2022 were at 104,000 thousand barrels. The inventory hasn’t been that low since May 2008. At the start of 2022, there were 129,000 thousand barrels of distillate in our inventory, and at the start of 2021, 160,000 thousand barrels.

What is contributing to the declining inventories?

For one, refineries. Especially on the East Coast. In the past 15 years, the number of refineries on the East Coast has dropped from fourteen (14) to seven (7), going from producing 1.64 million barrels per day in 2009 to just 818,000 barrels per day in 2022. Over the last couple of years, COVID has also caused some of the refineries on the East Coast to reduce staff, or even close, because of a slowdown in demand, which means they have not returned to pre-pandemic levels, even though demand is high again.

Another reason for the declining inventories of diesel is the financial risk associated with moving the fuel from the Gulf – where most of our fuel comes from – to the Northeast, when the market is in backwardation. Backwardation is when the current price, or spot price of oil is higher than prices trading in the futures market. Since it can take more than two weeks for the fuel to arrive from its source in Houston to the New York area, if prices drop during the time the fuel is traveling in pipelines, then a significant amount of profit would be lost – which is not a risk traders will take, especially when there’s money to be made selling diesel overseas instead.

Which leads to the third reason for shortage, the war in Ukraine. Much of the world is trying to stop its dependency on Russian oil, with members of the G7 pledging to stop buying Russian oil last week. So, if the fuel isn’t coming from Russia, it has to come from somewhere. As such, the United States has been exporting more to Europe and even Latin America, who are willing to pay higher prices to receive their goods.

What can I do to get through this crisis?

Unfortunately, low inventory and high prices are here for the foreseeable future. It is critical that you plan ahead now for this reality. Some suggestions are as follows:

- Conserve energy as much as possible. Consider upgrading your heat and hot water control systems now to computerized / electronic controllers that can program heating and adjust according to actual temperatures.

- Reallocate current budgetary expenses. Consider reprioritizing certain buckets within your budgets.

- Access reserve funds. Consider early withdraws of reserve funds to pay down existing oil and gas debt.

- If you are managing a co-op or condo, reassess Monthly Maintenance Charges. Consider raising common charges now to account for skyrocketing oil and gas prices.

- Reevaluate future capital improvements. Consider putting off major capital expenses to a later date.

- Take Advantage of Energo’s payment discount option:

- Pay your fuel invoice online by eCheck within 30 days, receive a 1% discount on your invoice. Visit myaccount.energo.com to make a payment

- Pay your fuel invoices by credit card and take advantage of card payment terms

At Energo, our experts are continuing to monitor the extreme price volatility in the energy markets, and we will continue provide you with valuable information to help you make the most informed decisions. If you’re concerned about how to manage your fuel needs or rising energy costs, reach out to an experienced Energy Advisor today.